|

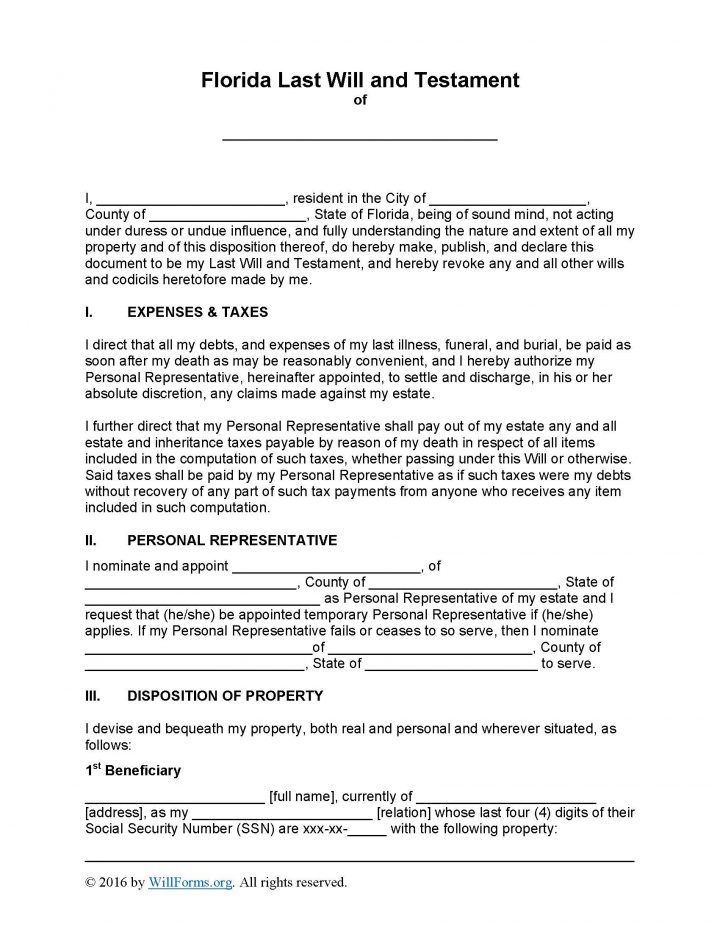

Florida Last Will and Testament Form |

The Florida last will and testament is a legal a document that is designed to allow a testator to provide a record, in writing, stating the specifics with regard to how they would like their estate, (real property and/or personal property) to be distributed among their chosen beneficiaries once they are deceased. The document will also provide the ability for the testator, to delegate someone they trust as their executor, who is willing to ensure that the instructions according to the testator, are properly executed according to their wishes. Once the document is completed, in order to be effective, signatures must be witnessed and acknowledged by two witnesses and, though optional, a notary. FL Section 732.502. The testator may feel secure in the fact that the document may be changed or revoked at any time.

Laws – §732.101-901

How to Write

Step 1 – Once downloaded establish the author of this document by entering the Testator’s name into the first line at the top of the page

- Submit the testator’s name

- City

- County

- Review the remainder of the paragraph

- Read titled section “Expenses and Taxes”

Step 2 – Personal Representative – The Testator may appoint their executor who will watch over the distribution of the estate, by providing the following information:

- In line 1 provide the name of the selected executor

- Address

- County

- State

In the event, at any point, the initial executor becomes unable or unwilling to carry out these responsibilities, the testator may appoint and alternate executor by provision of:

- Alternate exector’s name

- Alternate’s address

- County

- State

Step 3 – Disposition of Property – The testator may enter their selected beneficiaries and bequeathed property into this document. If there are more than three (3) beneficiaries, add the additional beneficiary’s information on a separate sheet and attach it to the document:

- Enter the full name of each beneficiary

- Beneficiary’s current address

- Relationship

- Provide the last four (4) digits of each beneficiary’s Social Security Number (SSN)

- The Principal must read review and agree to the next two paragraphs. If the testator would like to provide additional information they may do so by adding a sheet with additional instructions and attaching it to this form

Step 4 – Titled Sections and all Subsections- The Testator must review all the following titles and subtitles:

- Omissions

- Bond

- Discretionary Powers of Personal Representative (subsections A – K)

- Contesting Beneficiary

- Guardian Ad Litem Not Required

- Gender

- Assignment

- Governing Law

Step 5 – Binding Agreement – The Principal must review the first paragraph. In the second paragraph, enter the following

- Testator’s name

- A date of exectution of the document- dd/m/yy

- Testator’s name

- Testator’s printed name

- Date signature in dd/m/yy format

- Enter the Testator’s name

Step 6 – Witness Signatures and Notary Public –All signatories must be present before a notary public to provide signatures

Witnesses –

- Respective Witnesses must submit their signatures

- Enter complete current addresses

Testamentary Affidavit –

- A notary must acknowledge this document after completion, all parties must be present to sign this document in the presence of one another

- The notary will submit the names of the parties

- Provide the signature of the Testator

- Provide the signatures of the witnesses